RuPay Card: RuPay is an Indian domestic card scheme, launched by the National Payments Corporation of India (NPCI). RuPay cards are designed to provide a domestic alternative to international card schemes like Visa and MasterCard. Here are some key points about RuPay cards:

- Types of RuPay Cards:

- RuPay offers various types of cards, including debit cards, credit cards, and prepaid cards. These cards can be used for transactions within India.

- Acceptance:

- RuPay cards are primarily designed for use within India, but some variants also allow international usage. However, the acceptance of RuPay cards outside India may be limited compared to international card schemes.

- Partnerships:

- Various banks in India, including public sector banks, private banks, and regional rural banks, issue RuPay cards. These banks collaborate with NPCI to offer RuPay-branded debit and credit cards to their customers.

- Security Features:

- RuPay cards come with standard security features such as EMV chip technology, PIN-based authentication, and two-factor authentication for online transactions.

UPI (Unified Payments Interface):

UPI is a real-time payment system developed by the National Payments Corporation of India (NPCI). It enables users to link multiple bank accounts to a single mobile application and make seamless electronic fund transfers. Here are some key points about UPI:

- Fund Transfer:

- UPI allows users to link multiple bank accounts to a single mobile application and transfer funds instantly between these accounts.

- Mobile Apps:

- UPI transactions are facilitated through mobile apps provided by banks. Users can download their bank’s UPI-enabled app to avail UPI services.

- Unique Identifier:

- Each user is assigned a unique identifier called a Virtual Payment Address (VPA), which is used to send and receive money. Users can also link their mobile numbers to their accounts for UPI transactions.

- QR Code:

- UPI transactions can be initiated by scanning QR codes. Merchants often display their UPI QR codes, allowing customers to make payments by scanning the code.

- Security:

- UPI transactions are secure

About Us:

RuPay stands as India’s pioneering domestic card payment network, offering widespread acceptance at ATMs, point-of-sale (POS) devices, and e-commerce platforms throughout the country. It provides a highly secure network that safeguards against anti-phishing, embodying the essence of India’s own initiative for card payments. The name “RuPay,” derived from “Rupee” and “Payment,” underscores its status as a distinctly Indian solution in the world of card payments, reflecting pride in our national identity.

Aligned with the Reserve Bank of India’s vision for a ‘less cash’ economy, RuPay encourages every Indian bank and financial institution to embrace technology, actively participating in the shift towards electronic payments.

A Product of the National Payments Corporation of India (NPCI)

RuPay is a flagship product of the National Payments Corporation of India (NPCI), the overarching organization powering retail payments in the country. Established under the provisions of the Payment and Settlement Systems Act, 2007, NPCI was created through the joint efforts of the Reserve Bank of India (RBI) and the Indian Banks’ Association (IBA) to establish a secure electronic payment and settlement system in India.

Recognized as a “Not for Profit Company” under relevant company laws, NPCI’s mission is to build essential banking infrastructure, driving India towards a ‘less cash’ economy by fostering tech-driven innovations in retail payments.

Seven Years of Impactful Journey

Over the past seven years, RuPay has significantly transformed the retail payment landscape in India. Inaugurated by the Honorable President, Shri Pranab Mukherjee, endorsed by the Honorable Prime Minister, Shri Narendra Modi, and later adopted as the card of choice for the ambitious Pradhan Mantri Jan Dhan Yojana, RuPay has become a well-known name.

During this journey, RuPay has introduced various card variants tailored to different segments of society. In addition to government scheme cards, RuPay Classic, Platinum, and Select variant cards cater to both mass and affluent customers, offering a range of privileges such as international acceptance, airport lounge access, insurance coverage, merchant offers, cashback schemes, and health and wellness benefits.

Innovation in the Ecosystem

Staying in step with continuous development and innovation, RuPay has introduced a range of new products, including RuPay Contactless. With the vision of ‘One Card for all Payment Systems,’ RuPay Contactless has revolutionized payments by introducing offline wallet-based payment mechanisms and service area features for storing merchant/operator-specific applications. This product facilitates seamless payments across various use cases, including travel, retail shopping, and purchases.

RuPay Contactless – Tokenization

NPCI has invested in next-generation solutions such as tokenization and mobile-based point-of-sale (PoS) systems. These technologies enable Indian consumers to make secure card payments using their phones without revealing sensitive card details. Tokenization extends to smartwatches, wearables, and IoT-enabled devices, providing a secure means of conducting card payments.

Bharat Ecommerce Payment Gateway (BEPG)

Introducing BEPG, RuPay’s new e-commerce system aims to enhance the current e-commerce experience for RuPay cardholders. With a commitment to delivering a convenient and secure e-commerce experience, RuPay ensures a seamless transaction process without compromising on security.

Card Variants

Card Variants

RuPay, as a versatile payment solution, offers a range of card variants designed to cater to diverse segments of society. These variants provide users with different features and benefits to suit their preferences and needs. Here’s an overview of the various RuPay card variants:

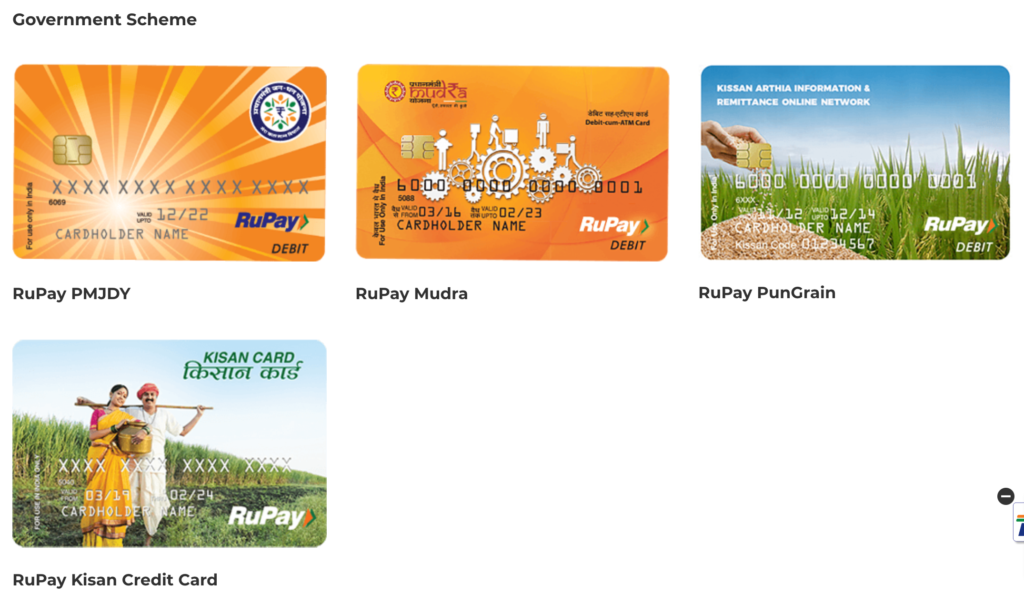

- Government Scheme Cards:

- RuPay plays a crucial role in supporting government initiatives, such as the Pradhan Mantri Jan Dhan Yojana. These government scheme cards are aimed at promoting financial inclusion and extending the benefits of digital payments to a wider audience.

- RuPay Classic:

- This variant is designed to serve the general public, providing essential features for everyday transactions. RuPay Classic offers a secure and convenient payment experience for a broad user base.

- RuPay Platinum:

- Tailored for those seeking additional privileges, RuPay Platinum offers an upgraded set of benefits. These may include international acceptance, airport lounge access, and enhanced insurance coverage, providing a more premium experience.

- RuPay Select:

- Positioned as the premium variant, RuPay Select is curated for affluent customers. It encompasses a comprehensive suite of privileges, including international acceptance, exclusive airport lounge access, personalized offers, cashback schemes, and health and wellness benefits.

These card variants reflect RuPay’s commitment to offering inclusive and specialized solutions, ensuring that users from different demographics can access the benefits of digital payments. Whether it’s meeting the basic needs of the general public or providing premium features for high-net-worth individuals, RuPay’s diverse card portfolio aims to address the varied requirements of its user base.